Growth Strategy Breakdown: How Zoho Became a $500M Company You’ve Never Heard Of

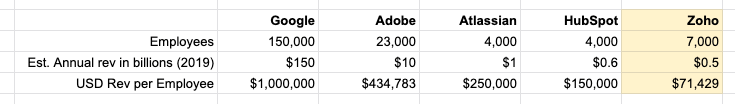

Zoho has quietly become one of the biggest SaaS companies in the world: they have roughly 7,000 employees and an estimated $500M in annual revenue as I write this in June 2019.

That puts them in the same neighbourhood as Xero, Slack, HubSpot, Box and Zendesk — other companies I’m sure you’ve heard a lot more about.

Zoho is an interesting company to study. On the surface, they’re just another company in the competitive company collaboration space. But dig deeper and you’ll find several intriguing stories, as they’ve deliberately taken a different path than most software companies and thus have a unique approach.

This post is split into two parts:

In the first part, we’ll explore Zoho’s strategy — to understand how they got to where they are today.

We’ll cover:

- What is Zoho’s unfair advantage?

- What is Zoho’s product strategy?

- What is Zoho’s go-to-market strategy?

- How does Zoho do marketing?

- How does Zoho approach culture & recruiting?

The second half of this post looks ahead to see what Zoho’s place in the market may look like in the coming years, with some thoughts on Zoho’s future.

Before we begin, a quick overview of Zoho:

- Founded in 1996

- Private company, led by Sridhar Vembu

- What they do: Zoho is a SaaS platform featuring a large suite of productivity / collaboration / marketing tools: from CRM to document signing to event management software and beyond

- Estimated annual revenue: $500M (source 1, source 2, source 3 — with some extrapolation)

What is Zoho’s unfair advantage?

A central reason for Zoho’s success is its ability to execute a classic geo-arbitrage play: produce goods in a country with a low cost of living (India), then sell the goods globally.

In an industry where they compete with companies mostly based in the US (a developed country with high salaries), Zoho’s low cost base gives them a major durable competitive advantage.

Zoho has grown to a large enterprise despite having a shockingly low (relative to its competitors) Revenue-Per-Employee metric.

Here’s what that looks like in practice:

A first reading of this could leave you in shock:

Holy crap! Zoho is super inefficient and unproductive.

But that would be an incomplete view. When you glance at Zoho’s salary ranges via Glassdoor, the picture becomes clearer. (I’ll save you a click: top engineers appear to make $10,000 USD per year.)

Think about that. Even if I’m off by a factor of 2 in either direction, Zoho is still a viable business.

Of course, while a low production cost base is not the only reason why Zoho is successful —we’ll touch on their product strategy in just a second —it is an extremely important advantage in the competitive fields in which they play.

Significantly lower COGS is a major reason why they’ve been profitable for so long, how they’ve been able to withstand competition from each of the above companies, withstand ebbs and flows in the market, and how they’re able to define their own destiny.

This fundamental advantage shows up in the rest of their strategy, as we’ll now explore.

What is Zoho’s product strategy?

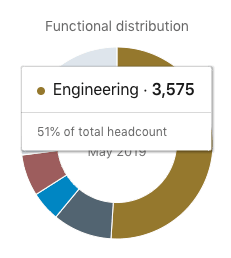

Because of this low cost base, and thanks to the engineering talent in India, Zoho has built a huge engineering and R&D team.

Engineering / R&D appears to make up over half the company, based on what we can gather from LinkedIn:

This army of engineers allows them to create and maintain a huge suite of products — 40+ at time of writing — which you can see here.

At current count, that’s 49 releases in the last 14 years.

What other company do you know that launches 3 products or services every year for over a decade?

In this way, Zoho’s high-output product strategy more closely resembles that of a video game studio or that of Rocket Internet, than a traditional SaaS company.

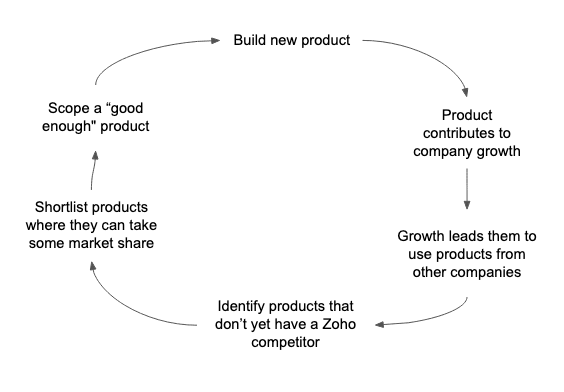

This should give you an idea of how they’ve grown so large, while revealing the foundations of Zoho’s product strategy:

Their vision is that you can run your entire business with Zoho, and so they use their own experiences to inform their roadmap.

As a large enterprise with hundreds of teams, Zoho inevitably bumps into constraints and new uses cases where they have to use products from other companies. When this happens, an evaluation takes place: can we do a fast-follow and make a cheaper version of this product?

Zoho doesn’t need to build category-leading, standard-defining products. They’re competing on the fact that they can build good enough products that you’ll try, and over time you’ll be using so many Zoho products that the gravitational pull of their ecosystem is so strong that you’ll just stick with them.

This also gives them pricing leverage. I can imagine a Zoho salesperson saying something like, “Sure, you could put your team on Slack, but since you’re already using Zoho CRM and Zoho Recruit, I can give you a preferential pricing on Zoho Cliq.”

Zoho Cliq doesn’t need to be better than Slack. It just needs to be good enough. Zoho’s product strategy and resource allocation is such that they’ll never be the BEST at one thing; their offering is that they have good-enough products at the most accessible prices on the market.

The market implications of building out a giant suite of products is something we’ll address later in the second half of this post, but for now we continue by exploring Zoho’s go-to-market strategy.

What is Zoho’s go-to-market strategy?

Like most of their contemporaries in SaaS, Zoho’s GTM is split up into a Direct business and Channel (reseller) business.

Their Direct business is a classic freemium go-to-market strategy.

Freemium is one of those things that is very simple in theory:

1. Offer a free product.

2. Get lots of users.

3. Show them value.

4. Some users become paying customers.

5. Keep more customers than you lose.

Looks straightforward, but very hard to do in practice. Each of those steps is really hard and countless companies have died trying to pull it off.

However, remember that Zoho has an inherent advantage with their low cost base. This means that they have the time, budget and patience to refine their freemium go-to-market for each of their 40+ products.

This freemium GTM then feeds their channel business, which has over 1,400 resellers globally, and currently is about a third of their overall revenue.

Here again, the advantage of low COGS makes an appearance: Zoho’s products are already priced well below their competitors, yet they still have enough margin to give commissions to build a channel business.

Furthermore, as anyone who’s built a reseller program knows — channel programs require a lot of human attention. Channel partners are another set of customers, but because they’re also advocates for your brand, they’re customers that have to feel more loved, valued and supported than Direct customers.

This means that Zoho must have a dedicated team to support the channel business, enabling partners and doing things like running user conferences all over the world.

This is not groundbreaking — Salesforce and Adobe do the same thing — but consider that Salesforce and Adobe (and their resellers) sell to enterprises and thus have the Revenue-Per-Employee metric to justify such effort.

Zoho is doing the same thing, but sell primarily to SMBs.

The economics of this are only possible when you have an unfair advantage in COGS.

How does Zoho do marketing?

To understand Zoho’s approach to marketing, we have to begin with how Vembu thinks about marketing:

We save a great deal of money by politely declining to engage in marketing … Should we spend money marketing to you, or should we spend it on building products for you? (source)

This quote makes one thing clear: as a company, Zoho is product first then marketing second (or third, or … last.) I couldn’t find an overarching, consistent marketing strategy for Zoho, and that quote helped me understand why.

However, this doesn’t mean that Zoho doesn’t do any marketing. On the contrary, they do a lot of stuff.

Their approach to marketing appears to be loosely grouped around the following objectives:

1. Increasing brand awareness.

Zoho runs a lot of expensive brand campaigns.

They’ve run billboards in San Francisco. This was easily a six-figure campaign.

They ran a full-page ad in the New York Times. Again, not cheap.

They run TV ads in the US —including one during the NBA playoffs. Safe guess to say total cost for this campaign was several millions.

These are curious moves for a company that targets small businesses: how can a company that targets SMBs, and is the lowest-priced product in its category, get away with doing executing the above campaigns?

The answer to this goes back to where we started: Zoho’s COGS is really low!

Only Zoho knows whether those branding campaigns were worth it. But what we do know is Zoho has enough fat in their margins to run brand campaigns.

2. Improve product conversion & monetization metrics.

Zoho has an army of product marketers: you would expect this for a company that has 40+ products.

They’re responsible for classic product marketing tasks: running webinars, tweaking email nurture flows and bringing in customer feedback to try and increase conversions within the product they’re assigned to.

This perfectly fits in with Vembu’s vision for how marketing should operate within a software company: serving the product.

3. Run a standard SaaS digital marketing playbook.

If you analyze Zoho’s digital marketing campaigns, you’ll see all the usual suspects: SEM, SEO, lead generation, etc.

The only oddity is that I couldn’t find a consistent content marketing strategy. But then again, it’s not surprising given the subordinate role of marketing as a function in Zoho.

Perhaps the most interesting acquisition play via digital marketing was “tool” marketing: Zoho builds simple tools that target high-volume keywords, creating relevant visibility for their products:

These look like scalable tactics that align with the idea of “highlight the product, don’t do marketing” — yet it wasn’t a tactic that was consistently applied to all of Zoho’s products.

Overall, I was underwhelmed by Zoho’s overall approach to marketing, hoping to find more coherence and strategy.

However, given Vembu’s perspective on the role of marketing and the strength of their product-led freemium acquisition model, it’s possible that Zoho marketing doesn’t need to be any more than what it currently is.

How does Zoho approach recruiting?

Zoho’s ambition is to be the all-in-one operating system for businesses all around the world. This is a huge vision that requires (and will keep requiring) more and more people to join Zoho.

So how do they make sure that they continually bring in fresh talent?

Zoho has two core strategies for growing their team:

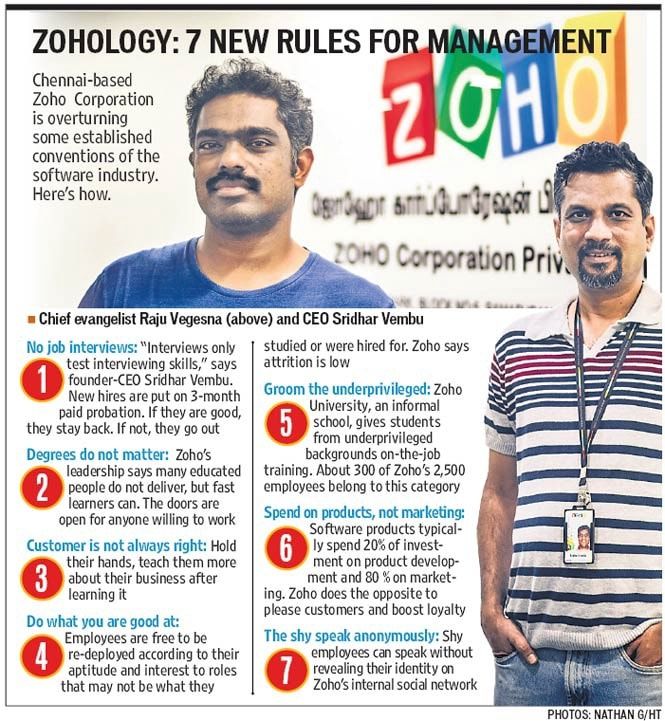

Differentiate with a unique culture

I should note, that Zoho’s culture isn’t the result of a calculated, “strategic” decision.

Listen to any interview Vembu does, and you’ll realize that he really just thinks differently compared to the rest of the industry, and Zoho’s culture reflects and amplifies his contrarian thinking.

This helps them stand out and compete for talent in India’s competitive tech job market, especially as more and more multinationals are moving into the country.

Zoho University

Zoho University is a program that takes in young people who can’t afford / wouldn’t have attended university, then prepares them for the workforce by teaching them skills via experiential learning.

One can interpret this from an optimistic and a cynical perspective.

The optimistic reading is that this is simply an extension of the Zoho culture and Vembu’s philosophies. Zoho stays private so that it can give back to the community and help her native India, one student at a time.

The cynical reading is that this is simply a way for Zoho to get (really) cheap labor that will stay fiercely loyal no matter what.

Regardless of your view, it’s a great strategy. Zoho University allows Zoho to continually have a pipeline of young talent that, at best, becomes future employees, and at worst, become evangelists for Zoho.

Part 2: Thoughts & Questions on Zoho’s Future Growth

As I was researching Zoho for this post, I ended up with a fairly clear understanding of how they got to where they are today.

And while I got some answers about Zoho’s past and present, I ended up with even more questions about their future.

In this section, I spend some time thinking about how the underlying dynamics in Zoho’s market could change, and what it might mean.

Can Zoho’s competitive advantage hold over time?

Throughout this post, I’ve highlighted how Zoho’s core advantage is its low production cost relative to its competitors.

Zoho can afford to throw bodies at problems because of its fat margins. Its competitors cannot.

So how will this play out? Well, historically, when you see this dynamic, there are two things that happen:

Scenario 1: Competitors strive to get more value & revenue per employee.

Competitors, recognizing they can’t compete on absolute headcount, start optimizing for efficiency and begin to squeeze out more productivity per headcount, looking for ways to deliver more value with fewer people.

This means that they’ll aggressively invest in things like automation, AI, and any new tech that enables them to do more with less.

This sounds innocuous, but a compounding effect kicks in. This has the effect of speeding up their rate of learning and experimentation, which leads to game-changing innovations over time.

An extreme example of this is Amazon’s ecommerce business. In a market with razor-thin margins, Amazon has reached a situation where it’s replacing factory workers with robots, inventing things like predictive ordering, and building its own delivery and logistics network.

This means Amazon will soon be playing the next version of a game that nobody else even knows how to play.

So what I’m saying is, basically, if Zoho’s low-cost model works too well for its competitors’ liking, Zoho would keep doing business as usual while the competition would end up creating the SaaS version of this:

Scenario 2: Competitors focus on the mid to high end, abandoning the low end to Zoho.

Zoho’s reputation in the market, along with its positioning, is consistent:

“Zoho is a lower-cost option than X”

When Zoho comes up in a competitive situation, the answer is

“We are the cheapest option. If you go with us, you’ll spend the least money.”

So if you’re the competition, and keep losing deals to someone who kills you on price, how do you deal with this?

Well, this is a competitive dynamic we’ve seen a zillion times before. Recall ~2012 when cheap Chinese phones started flooding the Android market, forcing Samsung to go upmarket and Apple to go even more upmarket?

What could happen here is that Zoho’s competitors pack up their chips and cede the low end to Zoho (who will always compete on price) while they move to dominate the middle and upper markets, where pricing is less of an issue, and where things like customer experience are more important.

If you browse through G2 Crowd reviews of Zoho products, you’ll notice that one of the recurring themes is a poor support experience, so it’s an area where competitors can claim (and have been claiming) advantage over Zoho.

What all this means is that Zoho could end up getting “stuck” with the low end customers, which are typically the hardest to deal with, require the most education, are likeliest to churn, and unfortunately, usually need the most support.

Not an amazing place to be in, even when you have huge margins.

Platform Strategy vs In-house Strategy

Another reason I find Zoho so interesting is because they’ve made a clear strategic decision to build out a giant product suite in-house.

This, despite our living in an age where platforms have proven to be a successful model: Apple, Shopify, Salesforce, Facebook — these are all companies that have massively benefitted from a platform strategy. Instead of building all the functionality on their own, they let third parties develop on their platform, fill their gaps, and in many cases, extend the usefulness of their platform.

The advantages of running a platform are clear. As long as you provide scale, third parties will provide you the breadth and depth of products that you would not have been able to build yourself. These companies compete for your users, resulting in your customers getting better and better products, and giving you valuable data to inform your future roadmap.

Contrast this to an in-house strategy, where, while you have the advantage of everything connecting more neatly in the backend (in theory), you have the disadvantage of not having competitive dynamics force your product to be better.

A common criticism I’ve heard about Zoho products is that they just copy what’s out in the market and make it cheaper. I don’t mean this in a bad way: fast-follow is a totally valid product strategy, as I highlighted in the first half of this post. This sentiment is a logically consistent outcome given their in-house product strategy.

Furthermore, at their current scale of 40+ products, there’s simply no way that all 40+ products are successful or have the same traction. There’s some level of VC portfolio theory kicking in here: I’m guessing that it’s 2–3 products are “carrying” the entire suite. I’m sure the internal appetite and internal talent to develop and improve Zoho apps is unevenly distributed.

And so the danger here is that Zoho’s competitors —with broader and deeper products that improve faster because of competitive dynamics — could systematically leapfrog Zoho’s “cash cow” apps one by one, to the point where it doesn’t matter if Zoho is cheaper.

I would assume that the Zoho counterpoint to this is that the market is big enough, or that there will always be enough demand for an “all-in-one” solution. I’m curious to see how this will unfold.

Internationalization strategy that lacks focus?

International expansion is straightforward in theory, especially with a freemium go-to-market:

You watch which countries are adopting your product, you look at the rates of conversion and monetization, then you pick regions where you think further investment could accelerate growth.

But as you internationalize, and start getting into the weeds of product localization, you realize that things can start to get really hairy.

This is a problem even with just 1 language, or just 1 product.

But when you’re Zoho and have 40+ products, the difficulty doesn’t increase linearly: it increases exponentially.

On the surface, it’s simple: you just make sure that the homepage and core product flows are localized, and that your help docs are also in the local language.

But then you dig deeper, and you realize it’s not so simple. What if you make a change to the product? What if you want to write new homepage copy? What if there are new ways for the products to connect with each other and transfer data? What if you want to update email nurture flows?

If you want to do internationalization right, it adds a lot of overhead to the product. With 40+ products across multiple languages — there are undoubtedly a lot of inefficiencies happening within Zoho, which could lead to lots of things breaking in the user experience.

As a brief example, some Zoho products are localized into 25 languages, and some are localized into 15.

This gives you an idea of how an unfocused internationalization effort creates gaps in the customer experience.

I’m not sure Zoho has their international expansion plans figured out, or if they’re doing small, incremental investments in various regions before making bigger moves.

What is clear though, is that going multi-language and multi-region is supposed to accelerate your growth. If you do it in an unfocused and haphazard way, your best case scenario is that you end up with pockets of customers all around the world — but they’re unhappy; and the worst case scenario is that you’ve created a permanent execution drag on your product development.

Conclusion: Zoho is an interesting company to watch

Zoho is going to keep getting bigger: the company has a critical mass of customers all around the world, and the company is resilient and talented enough to withstand several worst-case scenarios.

And this is good for everyone. Zoho’s success shows that there are many paths to growth outside of the VC → IPO model; there is no “best path” for software companies. It’s possible to grow to a large company with a global customer base without having to ring the bell at the NYSE.

As the world becomes more international, Zoho could prove to be a useful model. Perhaps there are entrepreneurs in other countries with a huge population and emerging development talent that may follow in their footsteps.

I can imagine that tech entrepreneurs from countries like the Philippines, Vietnam, Brazil and Nigeria are studying Zoho’s approach closely, hoping to one day have a similar story.

The industry needs more examples like Zoho: non-US based companies that punch well above their weight, with unique operating models that keep some of the world’s biggest SaaS companies on their toes.